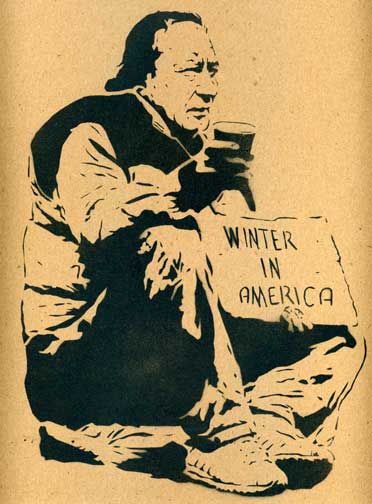

I always presumed that economists deliberated before sending world economies into tailspins, for their own gain. I guess I’m also guilty of “trusting” the system. Yet each day I read something like the article below I realize, this is a poker game gotten out of everyones hand.

So I’m starting to accept that we are in a depression, minus gravity taking

the lives of those responsible, as it did in 1929. And understand that those who’ve always been stepped on and screwed over, will have it worse, and we really need to test our mutual support systems.

Does this concern anyone else?

Fannie Mae unveils loss of $2.3bn

Analyst John Raines on the problems at Fannie Mae

Problems in the US housing market have pushed mortgage finance company Fannie Mae into the red.The group sank to a net loss of $2.3bn in the three months to 30 June, against a profit of $1.97bn last year.

It comes days after its sister company Freddie Mac posted worse-than-expected results and its top executive warned house price falls are not over yet.Both government sponsored firms own, or guarantee, nearly half of the nation’s mortgage debt. Shares in Fannie Mae sank in the wake of the announcement, falling 9.8% to $8.98.

Difficult market

As mortgage guarantors, Fannie Mae and Freddie Mac, must pay out when people default on their loans. But as a result of recent woes in the US housing market and subsequent sub-prime crisis the pair have run into severe difficulty. Fannie Mae said that the current housing crisis had added to its woes to the tune of $5.3bn in credit expenses. The latest losses at the firm – which came in at more than three times analysts’ estimates – followed a $2.2bn loss for the first three months of the year.

“Our second-quarter results reflect challenging conditions in the housing and mortgage markets that began in 2006 and have deepened through 2007 and 2008,” said Daniel H Mudd, president and chief executive officer of Fannie Mae.

Cost cutting

He added that the firm had also taken steps to raise an additional $7bn to help it tackle the “most difficult US housing market in more than 70 years”. As part of the plan Fannie Mae is slashing its dividend by more than 85% to 0.05 cents, raising its fees and has taken steps to cut its costs by 10%. The group also said it would stop purchasing ‘Alt-A’ loans – loans made to borrowers with good credit but little proof of their income, or people who either put down a small deposit, or no deposit, for their loan.

But there was little to offer hope in near-term future with Fannie Mae warning that increased volatility in capital markets and deteriorating credit conditions meant that it would face more losses.

Bail-out

Last month, the federal government offered a financial lifeline to the two beleaguered companies offering to extend their line of credit. However, the financial aid may leave the taxpayer facing a bill of $25bn over the next two years. “The taxpayer is stuck if they have to be bailed out,” John Raines, deputy director of political risk for Exclusive Analysis told the BBC. He added that reports had suggested the actual cost could end up being anywhere in the region of between $10bn to $100bn. “Right now, Fannie Mae says it has the capital to weather the storm, but its looking more and more stormy by the day.”

Yes, the real concern is why this is happening. Bailouts will only prolong the sinking feeling, as the economy is strangled by record high mortgage repayments. When land prices dwarf long term wage averages, there’s less left for consumption and investment. Wages get squeezed and jobs are lost. The long term economic equation is rigged so that land prices outgrow wages. How? Read about the dangers of such bailouts and the cause of this cyclical 18 year mess via Michael Hudson – Chief Economic Advisor to Dennis Kucinich at http://www.earthsharing.org.au/2008/08/07/bailing-out-the-bubble%E2%80%99s-enablers/